Stranded Dollars: Exploring Dollar Underutilization Amid Africa's Shortage

At Splice, our mission is to revolutionize cross-border payments for traditional financial institutions and fintechs through the innovative application of stablecoins. Here is how, and why, this is important:

As African nations grapple with a persistent shortage of U.S. dollars, a paradoxical situation has emerged: significant amounts of dollars remain untapped and underutilized. One of the reasons for underutilization stems from regulatory restrictions preventing financial institutions from leveraging dollar stablecoins—cryptocurrency tokens pegged to the U.S. dollar. While these digital assets could potentially ease liquidity pressures and facilitate smoother cross-border transactions, current policies leave them stranded on the sidelines. This article aims to shed light on the extent of dollar underutilization in major African economies such as Kenya and Nigeria, examining the regulatory barriers causing this phenomenon and quantifying the surprising volume of untapped dollar liquidity present in these markets despite the ongoing shortage.

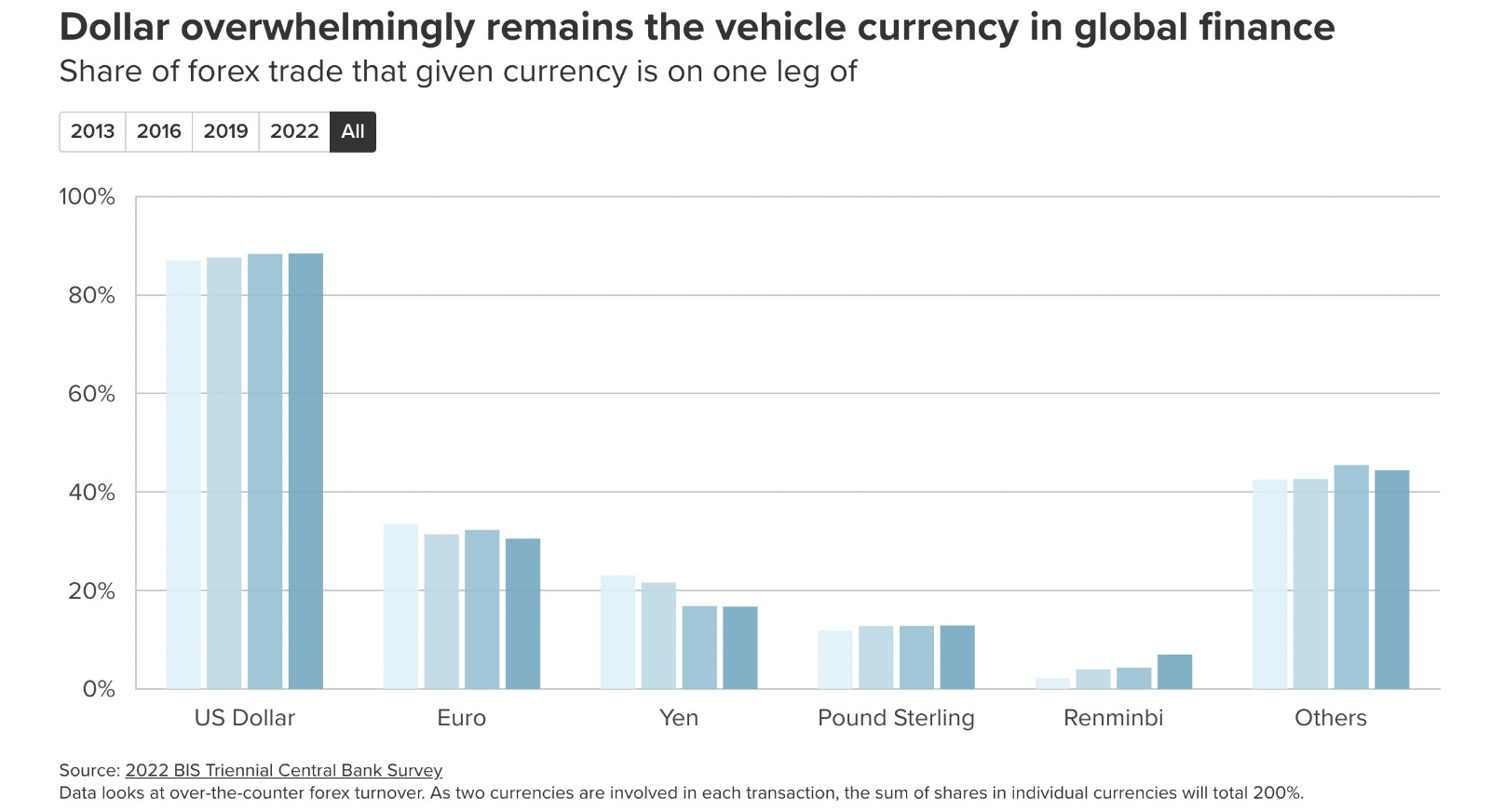

The U.S. dollar reigns supreme in global commerce, serving as the primary medium of exchange for international trade. While currencies like the Euro and Yen play significant roles, they pale in comparison to the dollar's dominance. This preeminence has elevated the U.S. dollar to the status of the world's de facto trade currency.

Consequently, nations across the globe, including those in Africa, must maintain substantial dollar reserves. These reserves serve multiple critical functions: facilitating the purchase of goods and services on the international market, enabling cross-border money transfers, and meeting foreign debt obligations. This dollar-centric system underscores the currency's pivotal role in shaping global economic interactions and highlights the challenges faced by countries with limited access to U.S. currency.

The scarcity of U.S. dollars in many African countries stems from a fundamental imbalance: dollar outflows exceed inflows. This is primarily driven by a trade deficit, where the value of imported goods and services surpasses that of exports. However, the picture is more complex. Remittances from Africans living abroad ($100 billion in 2022) and foreign direct investments ($45 billion in 2022) provide a crucial source of dollar income, while debt repayments ($112.3 billion in 2022) and repatriation of profits by foreign investors drain dollar reserves. Africa's growing population will further strain this situation, as increasing imports puts pressure on a system already tilted towards dollar outflows. The challenge lies in finding ways to narrow this gap and build a more sustainable dollar inflow. This problem also reduces the real value of local currencies as people are ready to pay a premium to get dollars because of the shortage. This affects people who are saving their money in these local currencies and businesses carrying out international trade who now have to pay more in local currency to get the dollar. Benjamin Fernandes has an amazing article about the dollar shortage crisis, titled “Is Africa’s dollar shortage ending anytime soon?”.

Here are some examples from a couple of African countries demonstrating how the dollar shortage problem affected these economies.

- Fly Emirates suspended flights to/from Nigeria because of failures from the Central Bank of Nigeria to repatriate profit in dollars made by Emirates in the country.

- Nigeria to take 2.25 USD IMF loan and issue diaspora bonds to attract foreign reserves.

- In 2023, Kenyan fuel and oil importers couldn’t import these commodities because of dollar shortage in the Kenyan market. This resulted in a scarcity in fuel that resulted in an increase in fuel prices. Energy is the foundation of every economy. If the price of energy goes up, the price of other commodities will follow.

- Tanzania's Bank of Tanzania (BoT) has pledged to redress the dollar shortage in 2024, saying it has put in place measures to control the situation. The measures include cautioning exporters to strictly ensure proceeds from exports are remitted within 90 days after trading to guarantee sufficient stock of dollars in circulation.

- Ethiopia, like many African countries, relies heavily on imports to sustain its medical supply chain. Currently, the country is grappling with a chronic foreign currency deficit, making it increasingly difficult to secure the dollars necessary for importing essential goods.

Dollar Underutilization

Beyond traditional dollar notes and digital dollars, African economies are witnessing the emergence of another form of dollar-denominated assets: stablecoins, more aptly termed "cryptodollars" in this context. As defined by Nic Carter and Matt Walsh of Castle Island Ventures, cryptodollars are cryptographic tokens circulating on public blockchains, designed to mirror the value of sovereign currencies. These digital assets come in various forms, each employing unique mechanisms to maintain their peg to the U.S. dollar. Our focus here is on fully-backed cryptodollars, which are directly convertible to dollar notes or digital dollars. The issuers of these tokens maintain their dollar peg through a robust reserve system. For every cryptodollar token in circulation, the issuer holds an equivalent amount of U.S. dollars or highly liquid dollar-denominated assets, such as U.S. Treasury bills. These reserves are typically held in regulated financial institutions, ensuring a 1:1 backing ratio. This structure provides a bridge between the traditional financial system and the burgeoning world of cryptocurrencies, offering new avenues for dollar liquidity in African markets.

Cryptodollars represent a revolutionary form of currency that operates on novel infrastructure: open blockchain networks. Unlike traditional payment systems, these networks function ceaselessly, without scheduled downtime or maintenance windows, ensuring 24/7 availability year-round. This constant operability, coupled with their open-source nature, provides a fertile ground for innovation, allowing developers to easily build and deploy financial products and services. Akin to physical cash, cryptodollars are bearer assets, with ownership determined solely by possession of the digital tokens. However, they surpass cash in one crucial aspect: transparency. The blockchain's inherent structure enables full auditability, allowing regulators and users alike to verify in real-time that issuers maintain adequate reserves to back their circulating tokens. This combination of continuous availability, programmability, bearer status, and transparency positions cryptodollars as a transformative tool which can be used by African innovators to address some of the payment and dollar shortage issues we face.

Cryptodollar Liquidity in African Markets

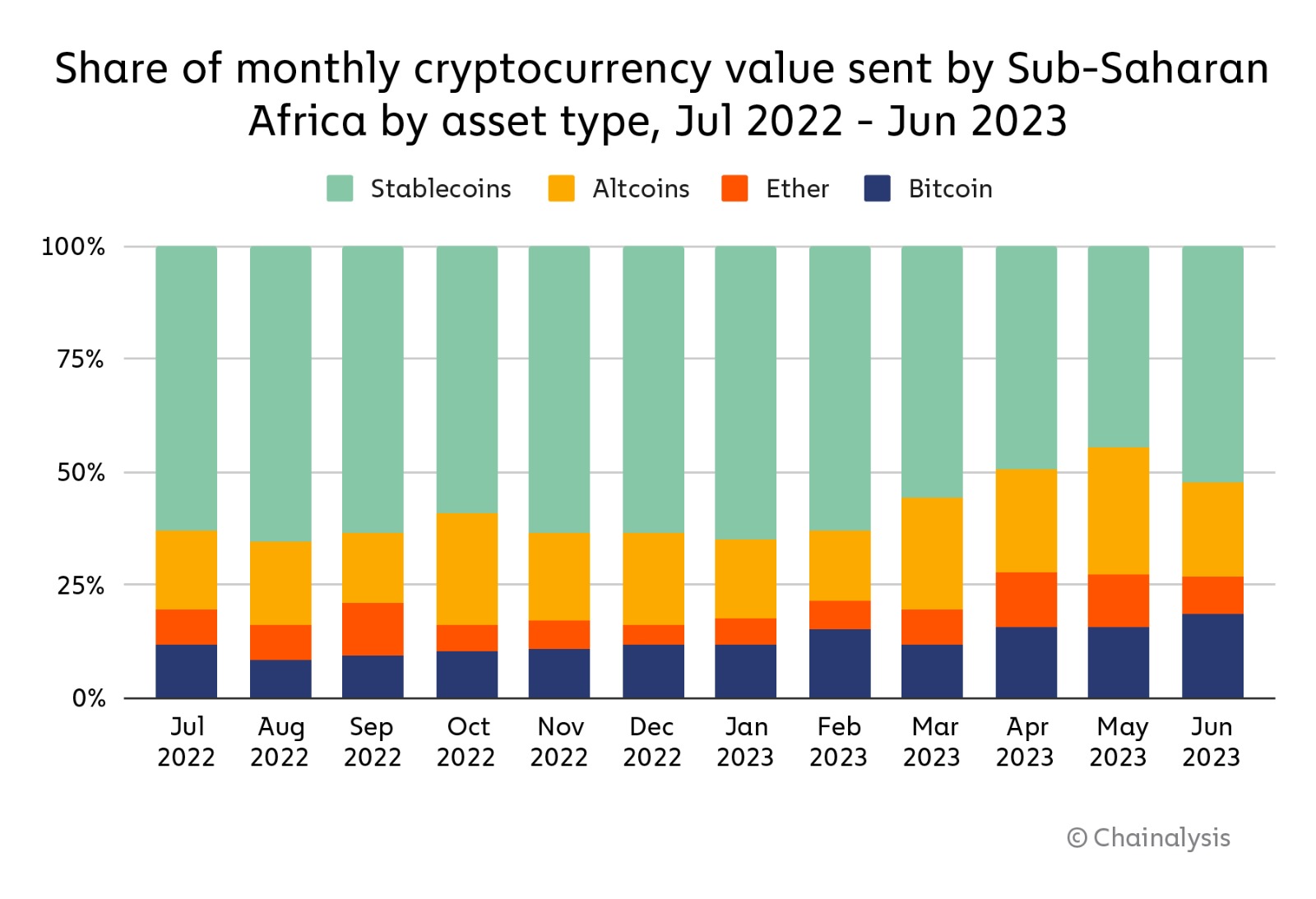

According to a report on Cryptocurrency adoption in sub saharan Africa published by Chain Analysis in 2023, stablecoins are estimated to account for approximately 50% of the activity on centralized cryptocurrency platforms like exchanges. This 50% is estimated to be equivalent to 30 billion U.S. dollars. It is important to highlight that these figures are not inclusive of activities occurring outside of centralized platforms such as exchanges. The following chart shows that an important part of crypto activity in Sub-Saharan Africa from July 2022 to June 2023 involved stablecoins.

If cryptodollars are so great, why are they not being used by financial institutions like banks to solve the dollar shortage crisis?

Traditional financial institutions, particularly banks, remain hesitant to engage with stablecoins, awaiting clear regulatory guidance from their respective central banks. This cautious stance stems from the lack of a cohesive policy framework recognizing stablecoins as a legitimate form of currency. Across much of Africa, regulators have adopted a skeptical, if not outright hostile, approach to these technologies, largely due to a limited understanding of their potential to address pressing economic challenges, such as the ongoing dollar shortage crisis. However, the regulatory landscape is not uniformly restrictive across the continent. South Africa has emerged as a frontrunner in crypto regulation, with the Financial Sector Conduct Authority (FSCA) and the Financial Intelligence Centre (FIC) classifying crypto as a financial product and initiating the registration of crypto asset service providers. Moreover, South Africa's Intergovernmental Fintech Working Group is actively exploring regulatory frameworks for stablecoins, signaling a progressive approach.

Nigeria, while lacking specific stablecoin regulations, has taken steps towards innovation by approving the launch of a Naira-pegged stablecoin, spearheaded by the African Stablecoin Consortium. Additionally, Nigeria has implemented guidelines for banks managing accounts for virtual asset providers, indicating a gradual opening to the crypto ecosystem. Kenya, by contrast, has adopted a more cautious stance, with their Capital Market Authority offering a sandbox for blockchain projects but stopping short of comprehensive legislation for virtual asset providers or stablecoins. This varied regulatory landscape across major African economies underscores the complex challenges in harnessing the potential of stablecoins to address dollar liquidity issues.

As of this writing, a landmark development has occurred in the global stablecoin landscape: Circle, one of the world's leading stablecoin issuers, has secured an electronic money institution license in the European Union. This pivotal achievement comes under the purview of the Markets in Crypto-Assets (MiCA) regulation, the EU's comprehensive framework governing stablecoins and other digital assets. The implications of this regulatory approval are far-reaching. It effectively paves the way for financial institutions across the EU to incorporate cryptodollars and cryptoeuros into their operational framework, treating these digital assets as legitimate forms of money.

Cryptodollar can reduce the severity of the dollar shortage problem

At Splice, by leveraging stablecoins and open blockchain networks, we've developed exceptionally cost-effective payment infrastructure that seamlessly integrates with existing financial systems. The true paradigm shift, however, lies in our enabling of financial institutions to utilize cryptodollars for intra-African transactions. This strategic use of stablecoins unlocks a new level of financial flexibility, allowing these institutions to reallocate their physical dollar notes and conventional digital dollars to more critical purposes. Our approach not only streamlines cross-border transactions but also addresses the persistent challenge of dollar scarcity in African markets. By providing a parallel system of dollar-denominated transactions, Splice is effectively increasing the overall dollar liquidity in the ecosystem, offering a pragmatic solution to a long-standing economic constraint. This innovative use of blockchain technology demonstrates its potential to solve real-world financial challenges, particularly in regions grappling with currency shortages and cross-border transaction inefficiencies.